Introduction to vat and gst difference

Taxes are essential for the sustainability of governments and the smooth running of economies. Among various forms of taxation, Value Added Tax (VAT) and Goods and Services Tax (GST) are two major indirect taxes that often cause confusion among business owners and consumers alike. This confusion stems from the similarities and differences that exist between these two taxation systems. Understanding the vat and gst difference is crucial for compliance, planning, and economic implications. The complexity of the tax system varies by region, making it imperative for stakeholders to grasp the nuances involved. This article aims to dissect these two forms of tax, explore their implementations across different countries, their impacts on consumers and businesses, and provide insights into future trends.

What is VAT?

Value Added Tax (VAT) is a consumption tax that is levied on the value added to goods and services at each stage of production or distribution. Unlike a sales tax, which is charged at the point of sale to the final consumer, VAT is collected at every stage in the supply chain. This means that businesses charge VAT on their sales and can reclaim the VAT they’ve paid on their purchases, effectively making the final consumer responsible for the VAT burden. The tax is generally a percentage of the sale price and is included in the sale price displayed to consumers.

What is GST?

Goods and Services Tax (GST) is also a value-added tax but combines the revenues of both state and federal governments. It simplifies the tax structure by replacing multiple indirect taxes like service tax, excise duty, and sales tax with a single tax on goods and services. GST is charged on the final consumption of goods and services and is a tax on value added at every stage of the production process, much like VAT. As with VAT, businesses under GST can claim credit for taxes paid on inputs.

Key Similarities Between VAT and GST

Both VAT and GST share a fundamental structure that aims to tax consumable goods and services. The inherent similarity lies in their operation as a multi-stage tax, where tax is applied at every step of the production and distribution cycle. Both taxes allow businesses to claim input tax credits, essentially eliminating tax on tax. The compliance measures, such as registration, record-keeping, and filing of returns, are also similar, making it crucial for businesses operating in jurisdictions that implement either of these taxes to maintain accurate and detailed records.

Understanding the vat and gst difference in Different Regions

VAT Implementation in Europe

In Europe, VAT is widely adopted and is a primary source of revenue for many governments. The European Union has set a framework for VAT, establishing minimum standards for its operation across member states. Each country can apply its VAT rate, which generally ranges from 15% to 27%. VAT systems in Europe are characterized by well-defined thresholds for registration, meaning that small businesses can remain exempt from VAT obligations if their turnover remains below a certain limit. Compliance is strictly monitored, with detailed reporting requirements imposed on businesses, leading to a relatively high degree of efficiency in tax collection.

GST Adoption in Asia-Pacific

The Asia-Pacific region has seen rapid adoption of GST, with countries like India, Australia, New Zealand, and Malaysia implementing the system to unify and simplify their tax structures. Each nation’s GST system presents unique challenges based on local economic conditions, which means that while the underlying principles are the same, the execution of GST can vary widely. For instance, India’s GST implementation involved four tax categories—central, state, integrated, and cess—leading to a complex compliance landscape that has required businesses to upgrade their accounting systems significantly.

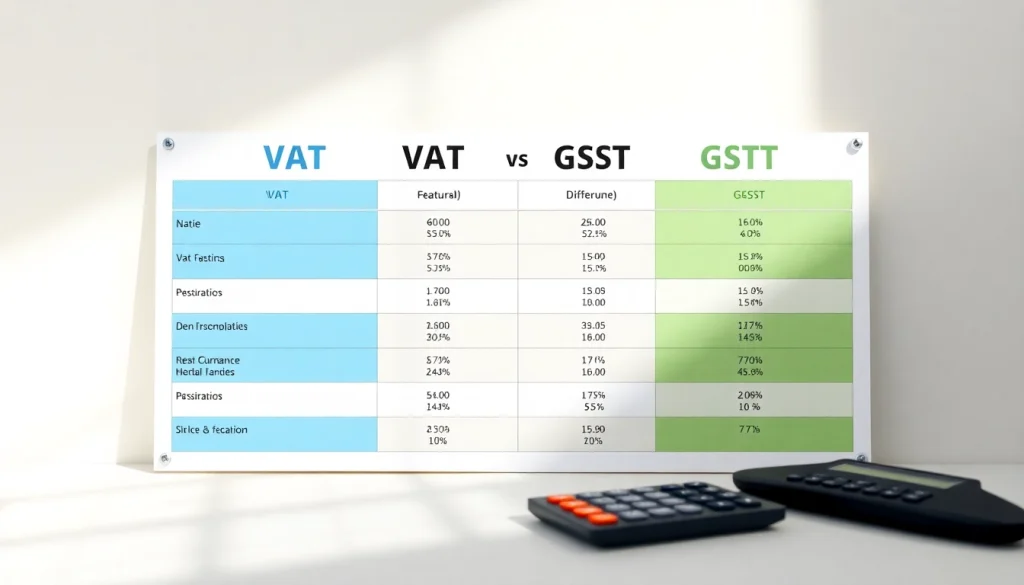

Comparative Analysis of Rates and Regulations

Comparing VAT and GST in terms of rates and regulations reveals marked differences influenced by regional economic conditions, government policy, and administrative efficiency. VAT rates in Europe typically range higher than many GST rates found in the Asia-Pacific region. Furthermore, the regulations governing VAT can be more stringent, resulting in a stricter compliance environment. For businesses operating in multiple countries, understanding these differences is vital for effective tax planning, risk management, and operational efficiency.

Major Impacts of vat and gst difference on Consumers

Effect on Pricing Strategies

The application of VAT and GST has significant implications for how businesses formulate their pricing strategies. The inclusion of indirect taxes can affect retail pricing, influencing consumer purchasing decisions. Businesses must decide whether to absorb the tax burden or pass on costs to consumers. This decision can significantly impact competitive positioning. In markets where consumers are price-sensitive, the extent to which businesses can pass along these tax costs will largely dictate their pricing strategies and ultimately their profitability.

Influence on Consumer Behavior

Consumer behavior is also affected by the structure and rates associated with VAT and GST. Higher tax rates may lead consumers to delay purchases, shifting their spending patterns. For instance, if a government increases VAT or GST rates, consumers may choose to purchase fewer non-essential items, thereby influencing market demand. Understanding these behavioral shifts can help businesses tailor their marketing strategies effectively, ensuring they align with consumer sentiment during various tax regimes.

Regional Variations in Consumer Experiences

Consumers across different regions experience VAT and GST differently due to variations in implementation and enforcement. In high-compliance countries, consumers may feel confident knowing that the taxes they pay contribute directly to public services. In contrast, in regions where tax evasion is rampant, consumers may feel disenfranchised. Such disparities highlight the need for tax authorities to engage with consumers transparent communication and education about how collected taxes are utilized.

Businesses and the vat and gst difference

Challenges for Business Compliance

For businesses, understanding the vat and gst difference is essential not only for compliance but also for strategic planning. The compliance landscape can be convoluted, with varied regulations, rates, and reporting requirements in different jurisdictions. Failure to adhere to tax regulations can lead to penalties, audits, and damaged reputations. Hence, businesses must stay updated with registration requirements, filing deadlines, and changes in tax laws in the regions they operate.

Strategies for Efficient Tax Handling

Efficient tax handling involves adopting robust accounting systems that automate calculations, record keeping, and filing processes. This can significantly reduce the manual workload and mitigate errors. Businesses should also invest in staff training and development to ensure employees are equipped to navigate the complexities of VAT and GST. Furthermore, engaging with tax professionals or consultants can provide valuable insights and guidance tailored to the business’s specific needs, which can enhance overall compliance.

Tax Advantages of Understanding the vat and gst difference

Understanding the vat and gst difference can provide distinct tax advantages for businesses. By accurately accounting for input and output tax credits, companies can optimize their tax obligations, enhancing cash flow and potentially reducing overall tax liabilities. Additionally, informed businesses can take advantage of tax incentives or exemptions that may apply based on their industry, geographical location, or scale of operations. In essence, a deep knowledge of these tax regimes can empower businesses to make strategic decisions that improve their bottom line.

The Future of Taxation: Trends in vat and gst difference

Technological Challenges and Opportunities

Technology is reshaping the landscape of taxation, bringing both challenges and opportunities. The rise of e-commerce has necessitated changes in how VAT and GST are collected and enforced, leading to innovations such as digital invoicing and real-time transaction reporting. However, this evolution also poses challenges, particularly for businesses that may struggle with the implementation of sophisticated technology systems. Adapting to these advancements is critical for businesses aiming to maintain compliance and competitiveness.

Policy Changes to Anticipate

Tax policies are subject to change, and stakeholders must stay attuned to potential reforms in VAT and GST systems worldwide. Governments may adjust tax rates or introduce measures aimed at curbing tax evasion, which could impact cash flow for businesses. Additionally, there may be shifts toward more environmentally friendly taxation structures as governments prioritize sustainability. Anticipating these changes enables businesses to adapt their strategies proactively rather than reactively.

Global Insights on VAT and GST Evolution

The evolution of VAT and GST systems worldwide provides valuable insights into how governments are striving for efficient tax collection while reducing compliance burdens on businesses. Global trends indicate a movement toward more transparent, simplified tax systems that utilize technology to enhance taxpayer experience. Countries that implement digital tax administrations can increase compliance rates, reduce fraud, and improve revenue collection. Observing these trends can position businesses to anticipate shifts in regulatory frameworks effectively.